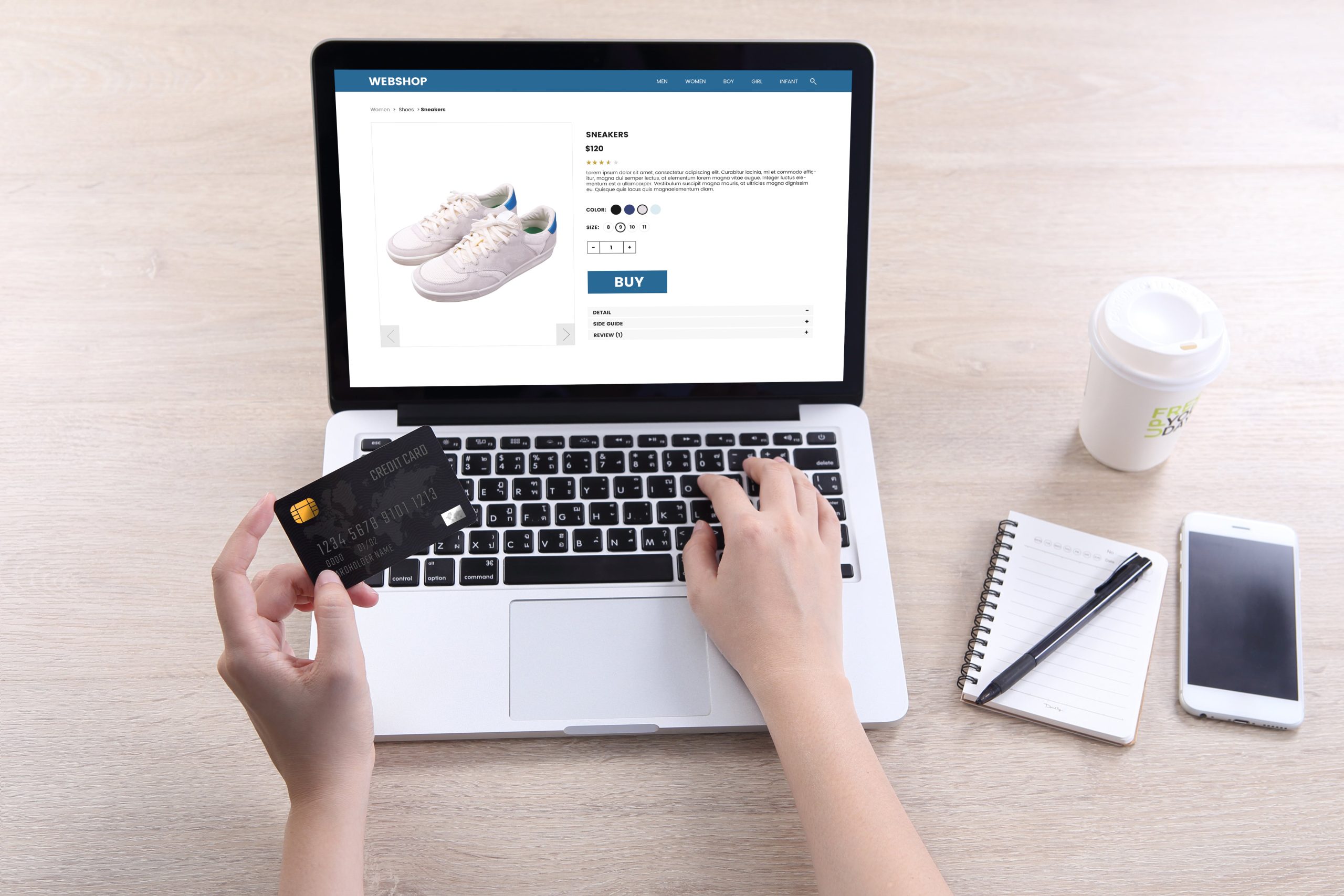

Ecommerce payment processing refers to the methods and systems used by online businesses to accept and process payments from their customers. It is a crucial aspect of any ecommerce operation, as it directly impacts the customer experience and the overall success of the business. In this article, we will provide you with an overview of ecommerce payment processing and cover everything you need to know about it.

Types of Payment Methods

There are various payment methods available for ecommerce businesses to offer their customers. The most common ones include:

- Credit and Debit Cards: This is the most widely used payment method in ecommerce. Customers can enter their card details, such as card number, expiry date, and CVV, to make a payment.

- E-Wallets: E-wallets like PayPal, Apple Pay, and Google Pay allow customers to securely store their payment information and make payments with just a few clicks.

- Bank Transfers: Some customers prefer to make payments directly from their bank accounts using online banking services.

- Cryptocurrencies: With the rise of cryptocurrencies like Bitcoin, some ecommerce businesses are now accepting digital currencies as a form of payment.

The Payment Processing Cycle

The payment processing cycle consists of several stages that occur from the moment a customer initiates a payment to the moment the funds are transferred to the merchant's account. Here are the main stages:

- Authorization: When a customer makes a payment, their card or payment details are verified for authenticity and available funds.

- Authentication: Once the payment is authorized, the customer's identity and payment details are further verified to prevent fraud.

- Capture: The funds are then captured or held for transfer to the merchant's account.

- Settlement: The captured funds are settled in batches, usually at the end of each business day, and transferred to the merchant's account.

The Payment Gateway

A payment gateway is a technology solution that enables the secure processing of online payments. It acts as a middleman between the customer, the merchant, and the payment processor. The payment gateway encrypts and securely transmits the customer's payment information to the payment processor for authorization and further processing.

Payment gateways also provide additional features, such as fraud detection and prevention, recurring billing, and multi-currency support. Popular payment gateway providers include Stripe, PayPal, and Authorize.Net.

Security and Compliance

Security is a top concern when it comes to ecommerce payment processing. Online businesses must ensure that their customers' payment information is protected from unauthorized access and potential data breaches. This is achieved through various security measures, including:

- Encryption: Payment data is encrypted using advanced cryptographic protocols to prevent interception and tampering.

- Tokenization: Sensitive payment information is replaced with unique tokens, reducing the risk of exposure in case of a breach.

- PCI DSS Compliance: The Payment Card Industry Data Security Standard (PCI DSS) sets requirements for securely processing, storing, and transmitting payment card data.

Integrating Payment Processing

Integrating payment processing into an ecommerce website can be done through various methods:

- Hosted Payment Pages: Using a hosted payment page provided by the payment gateway, where customers are redirected to complete the payment process.

- API Integration: Integrating the payment gateway's API into the ecommerce website to handle payment requests and responses directly.

- Shopping Cart Plugins: Many ecommerce platforms offer plugins or extensions that can be installed to enable seamless integration with popular payment gateways.

Fees and Pricing

Payment processing involves fees and pricing structures that vary depending on the payment gateway and the specific needs of the business. Common types of fees include:

- Transaction Fees: A percentage of each transaction amount or a flat fee per transaction.

- Monthly Fees: A fixed charge for using the payment processing service each month.

- Chargeback Fees: When a customer disputes a charge, a fee may be imposed on the merchant.

It is important for ecommerce businesses to carefully evaluate the fees and pricing structures of different payment processors to choose the most cost-effective option for their specific needs.

In conclusion, ecommerce payment processing is a critical part of running a successful online business. By offering a variety of payment methods, ensuring secure transactions, and integrating a reliable payment gateway, businesses can provide a seamless and secure payment experience for their customers, leading to increased customer satisfaction and ultimately, more sales.